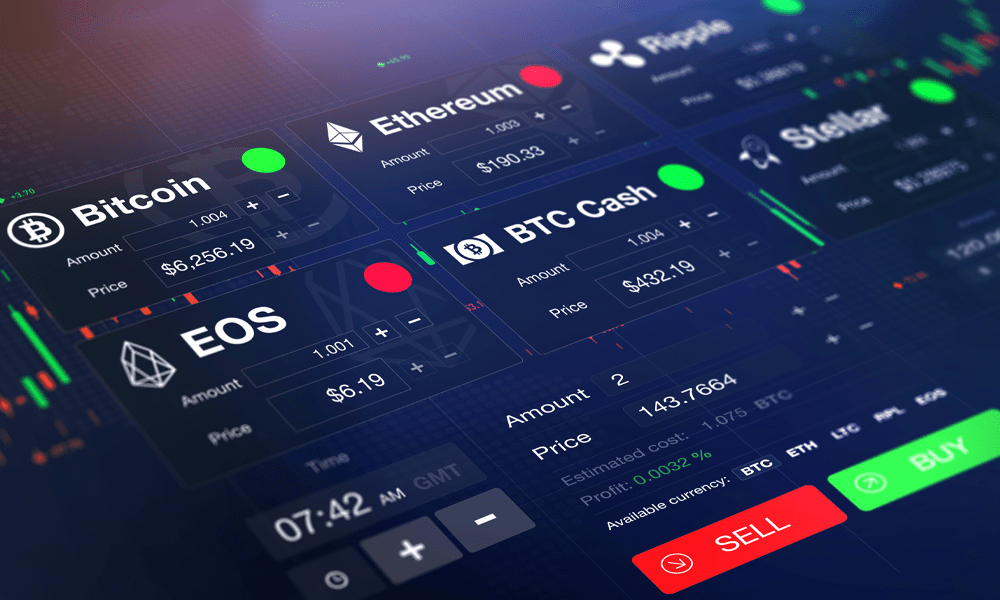

“The exchange fee is the initial transaction amount a trader should pay attention to while trading cryptocurrencies”.

Do you wish to invest in crypto trading platforms in order to make money? “Buy less and sell more!” sounds easy and simple, right? Well, the equation, however, is significantly more intricate than that, and the price variable is only one of many in the purchasing process. There are network fees, exchange fees, and conversion fees to consider, and even if the favoured trader forum claims zero fees, you should double-check the price tag, which may be 5-10% higher than the actual market rate. You need to be aware of any hidden charges or fees strategies of these third parties if you want to ensure that your calculations are accurate and that you do not lose money on an apparently profitable investment.

To learn more about crypto trading platform, please click on the link below https://www.delta.exchange/

Key Takeaways

- Since Bitcoin’s inception in 2009, the number of people trading and investing in cryptocurrencies has expanded dramatically.

- Hundreds of online internet exchanges now exist where you may sell, buy, and trade digital currencies.

In this post, we’ll look at five ways bitcoin traders might save money if their assets are losing value. The various transaction fees and hidden charges for crypto trading platforms are listed here.

- Exchange Fees:

When trading cryptocurrencies, the exchange rate is the first thing a trader should consider. The cost of a digital exchange to complete a purchase or sale order is known as the exchange rate. Most bitcoin transactions in India have a set payment mechanism, however, the final cost is determined by the area where the transaction is completed. As a savvy trader, you should conduct thorough research to determine which crypto exchanges have the most affordable transaction fees.

- Network Fees

Cryptocurrency miners are compensated for their efforts via network fees. Cryptocurrency miners are individuals who own strong computers dedicated to validating transactions for inclusion in the blockchain. In a nutshell, they ensure that the same token is not used twice and that the transaction is genuine in the crypto trading platform.

Cryptocurrencies do not manage network expenses and do not pay miners/network guarantors directly. Network fees are determined by demand and may rise if the network is overburdened. When utilizing an external corporate wallet, users are normally allowed to book transactions that they are prepared to pay for their services, but when using an exchange, it automatically stops the exchange to avoid any form of transfer delay.

- Wallet Fees

You retain your cryptocurrency in a digital wallet when you perform cryptocurrency transactions. A digital wallet functions similarly to an online bank account, allowing you to safely store your bitcoin funds. Crypto wallets allow you to access and securely store your cryptocurrency, as well as make it easy to use and transfer it to others. Most wallets don’t charge for cryptocurrency deposits and withdrawals, but they pay for withdrawing/sending bitcoin from a fund, which is essentially a network currency. The crypto wallet contains a merchant gateway via which you may refill your smartphone and DTH services, as well as organized bitcoin buying possibilities.

- Staking Fees

Staking fees are the latest and most expensive sort of fees at marketplaces. Coinbase imposes a fee of 25% on any and all staking profits, while Kraken isn’t too far behind with a cost of 15% on all ETH staking profits. If you stake through an exchange, you’re probably losing 15–30% of your profits due to their costs.

- Off-chain Fees

Internal transfers are usually free since most transactions keep all internal transactions offline and only start on-chain activity when coins need to leave their own exit.

The lightning network, on the other hand, provides some security to speed up the process and maybe decrease payments to pennies. Unfortunately, this is not a panacea, as it takes two nodes to open and close the channel each time through an on-chain exchange, which can result in hefty fees, especially if the channel sees any activity before closing.

Conclusion

While Crypto trading platform is a unique and interesting frontier in financial services, there are certain hidden charges to be aware of and manage. We’ve attempted to describe all of the different types of fees in order to help you keep as much of your hard-earned money in your pocket as possible.