To get a handle on the market, you need to grasp trading indicators like the Relative Strength Index (RSI). This tool is crucial for day traders because it tells you how fast prices are changing and if they’re stretched too far in one direction.

RSI swings back and forth, and when it hits certain levels, it suggests potential shifts in the market trend. By paying attention to these swings and thresholds, traders can spot when trends might flip, identify when prices aren’t in line with market momentum, and confirm whether current trends are strong or weakening. This helps traders make smarter decisions, especially in fast-moving markets.

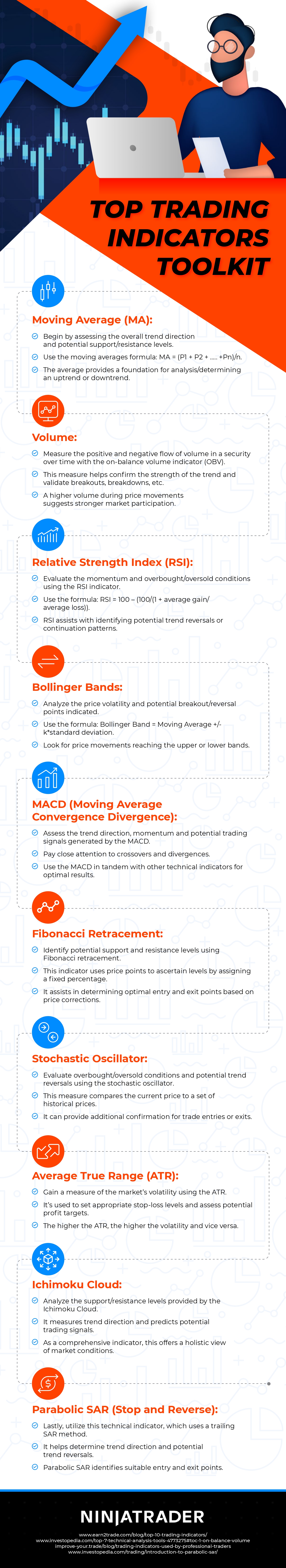

If you want more insights on RSI and other indicators to help you understand the market better, take a moment to review the resource highlighted below.

Top Trading Indicators Toolkit, provided by NinjaTrader and their platform for futures trading